Over the course of your investing life, you’ll encounter market lows and highs. Headlines often spotlight the extremes, especially when markets reach record levels. Take, for example: “Stocks Hit Record Highs. What’s Behind the Rally.”1

All-time highs have an interesting effect on investor behavior...

Technology has changed nearly everything about the way we live, work, and connect including how scammers operate.

Once upon a time, scams came in the form of clunky emails riddled with typos or too-good-to-be-true lottery wins. These days? The tactics are smoother, the impersonations more believable...

As spring arrives and the weather warms up, many people turn their attention to cleaning out closets and organizing their homes. According to a recent survey, about 80% of Americans have spring cleaning on their radar this year.1 While most focus on the physical space, spring is also a great time to...

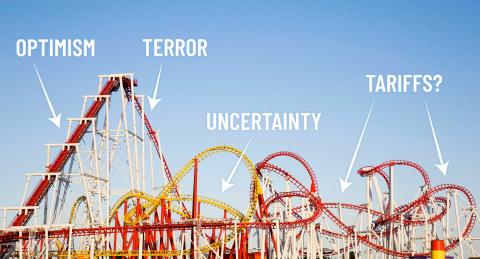

What makes one investor stick with their strategy through market swings while another panics and pulls out?

Often, it comes down to mindset.

Your investing mindset can shape how you make decisions, respond to volatility, and pursue financial goals.1 Without a strategy that aligns with that mindset, it...

Tax season might not spark joy, but a refund sure can.

In 2025, the IRS estimates the average federal income tax refund will top $3,170.1 That means a lot of folks are suddenly asking the same question: What should I do with it?

Splurge? Save? Invest?

The good news: there’s no one-size-fits-all answer...