Smart investing doesn’t happen in a vacuum.

Current events matter, and this year, the 2024 Presidential Elections are taking center stage.

That’s rattling a lot of us, causing more election stress than ever before.1

It’s also raising a lot of questions about investing in election years, how to respond to market uncertainty, and what money moves truly make sense.

Here’s a handful of key factors to keep in mind when you’re investing in an election year.

What was the last money mistake you made?

If you’re like most folks, you’ve made at least one upsetting money mistake in the past year — and you’d like to do better.

In fact, most folks admit their finances have not gotten better over the past year. And at least half of them say the real problem is that their money mistakes have turned into bad financial habits.

What happens when you start to feel afraid or greedy?

Do you feel like taking your time and waiting to make your next move?

If you know what mistakes tend to drain retirement savings, you can take caution, make more informed decisions, and stay on track to fund your dream retirement.

Mortgage rates have risen above 7%, leaving many buyers feeling like a reasonable mortgage is out of reach. While current rates look high compared to the ultra-low rates of the past decade, they aren't outrageous from a historical perspective.

The world of finance is never static. It's an ever-changing landscape that reflects the ebb and flow of economic indicators, political events, and public sentiment.

Lately, the chatter about market downturns and fiscal squabbles in Washington has reached a fever pitch. So, let's break it all down for better understanding.

The IRS recently updated some rules about trusts that could make your heirs accidentally liable for capital gains taxes.

It's another quiet change that could severely impact families trying to maximize their legacies.

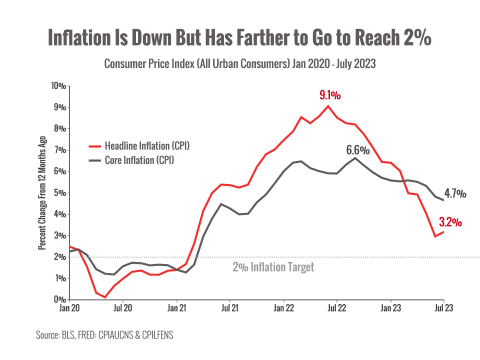

How high do you think the Federal Reserve will have to push interest rates to fully tame inflation? Let’s discuss.

How often do you set new financial goals? How often do you achieve them?

Most of us aren’t very successful with our goals, even when we have the best intentions and strong willpower.1 Sometimes, that’s because we’re setting unattainable goals. Other times, we’re missing the big picture and setting our goals with blinders on.

One of the least understood forms of protection is personal liability insurance; and with its capacity to form an extensive umbrella of financial protection for a low cost, it can also be the most overlooked. Most people don’t consider it because they think they have plenty of liability coverage in their homeowners and auto insurance policies.