Many of us have experienced the cost of financial literacy gaps at one point or another. And if you’re like most folks, the gaps in your financial literacy

Being financially literate in today’s economic climate is more important than ever. Understanding finances can help you make better money management decisions

Most nonprofit organizations today offer a variety of planned giving options that supporters can take advantage of. If you’re committed to supporting an

If you’re in your 20s, rejoice! You’re in a great position to create the life you want, starting with a secure financial future. While it’s common to feel

Have you ever wondered exactly what those initials after a financial professional’s name mean? You’re definitely not alone. The easy way to tell is to visit

While it may not seem so, there are a lot of painless ways to save money. Not just for those who have a limited cash flow, but also for those with plenty of

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

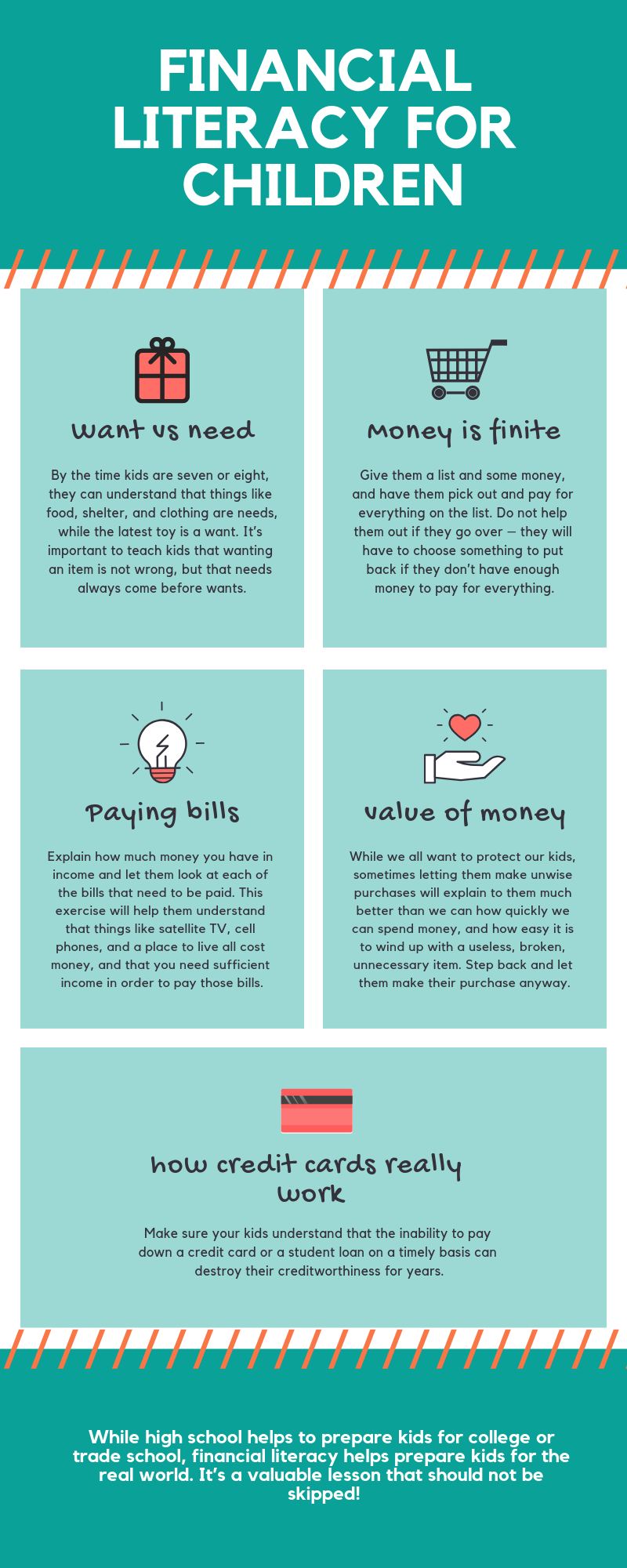

In a recent survey by JumpStart Coalition for Financial Literacy, only 26 percent of those between the ages of 13-21 said that they had been taught how to

If you’ve ever played the Game of Life board game, it becomes clear that compressed into the colorful path there are various stages of life. Each stage holds

If you’re just starting to take charge of your financial future, it can be stressful approaching financial planning with confidence. Do you ever talk to your