Technology has changed nearly everything about the way we live, work, and connect including how scammers operate.

Once upon a time, scams came in the form of clunky emails riddled with typos or too-good-to-be-true lottery wins. These days? The tactics are smoother, the impersonations more believable...

As spring arrives and the weather warms up, many people turn their attention to cleaning out closets and organizing their homes. According to a recent survey, about 80% of Americans have spring cleaning on their radar this year.1 While most focus on the physical space, spring is also a great time to...

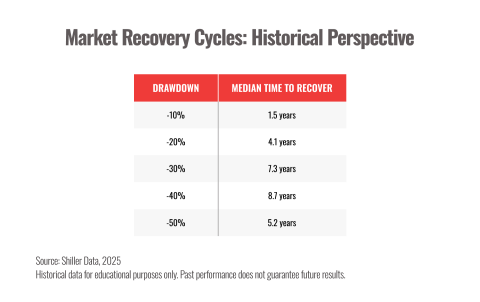

What makes one investor stick with their strategy through market swings while another panics and pulls out?

Often, it comes down to mindset.

Your investing mindset can shape how you make decisions, respond to volatility, and pursue financial goals.1 Without a strategy that aligns with that mindset, it...

Tax season might not spark joy, but a refund sure can.

In 2025, the IRS estimates the average federal income tax refund will top $3,170.1 That means a lot of folks are suddenly asking the same question: What should I do with it?

Splurge? Save? Invest?

The good news: there’s no one-size-fits-all answer...

What do you do when faced with a complex financial challenge?

Do you seek an immediate solution, or do you take the time to fully understand the issue before acting?

The way you approach financial decisions often depends on your perception of time - specifically, how much time you believe you have to...

Tax season doesn’t have to feel like an uphill battle. With the right strategies, you can minimize your tax bill and keep more of your hard-earned money where it belongs, in your pocket.

Whether you’re a DIY tax filer or rely on a pro, understanding these key moves can help you make smarter financial...